The fin tech start up scene is a thrilling blend of financial innovation and entrepreneurial spirit. It’s attracting a wave of bright minds and disrupting the way we manage our money. But this fusion of finance and technology is complex. To really understand how it works, we need to break down the elements.

Table Of Contents:

- What Makes Fin tech Start ups Different?

- Funding and the Future of Fintech

- Navigating the Fintech Landscape: What to Consider?

- FAQs about Fin Tech Start Up

- Conclusion

What Makes Fin tech Start ups Different?

Unlike traditional financial institutions, fin tech start ups are all about agility and leveraging new technologies to address unmet customer needs or make existing processes more efficient and accessible. Think of them as disruptors. Fin tech start ups are using tech to create novel solutions in areas like payments, lending, investments, and financial literacy.

Key Areas Where Fin tech Start ups Shine

1. Payments Processing

Fin tech start ups are changing the way money changes hands. Startups like Stripe, acquired by PayPal in 2013, offer seamless online payment processing, empowering businesses of all sizes.

2. Alternative Lending

Access to credit scoring and financing is being revolutionized by fin tech start up companies like Upstart and LendingHome. By using alternative data points beyond traditional credit scores, these platforms help borrowers get financing that they may not have accessed before.

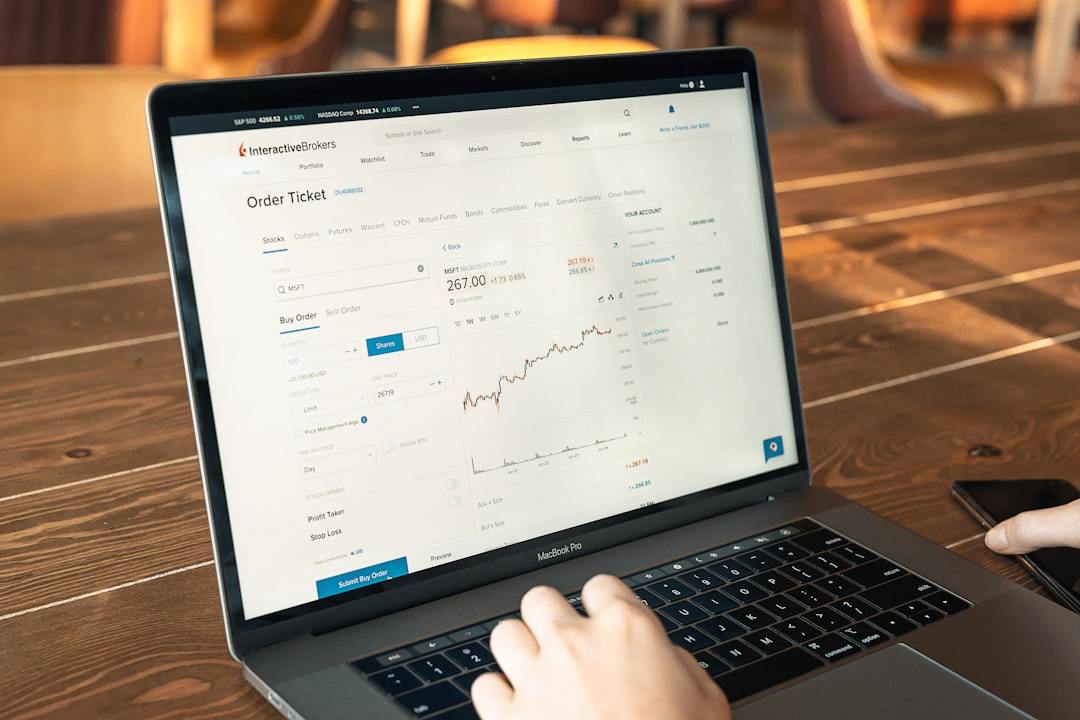

3. Robo-Advising

Investing fintech platforms is becoming more accessible thanks to robo-advisors such as Betterment and Wealthfront. They leverage data science algorithms to offer personalized investment advice, often at a fraction of the cost of traditional financial advisors. Platforms like these investment advisors are incredibly helpful for novice investors and those looking to make managing investments more straightforward.

4. Personal Finance Management

Cash Apps like Truebill give consumers a better grasp of their financial lives. From tracking spending habits to negotiating bills, these apps empower users to make better financial decisions.

Funding and the Future of Fintech

It’s undeniable: the fintech space is attracting massive investment. Companies like Valon, a tech-driven mortgage servicer, raised significant capital from investors like Andreessen Horowitz (a16z), showcasing investor confidence. Although the landscape can shift, the need for cutting-edge financial tools remains.

Fintech Success: Understanding the User

Successful fintech startups prioritize their users and understand the importance of financial technology:

- Seamless User Experience: Intuitive interfaces, just like the ones built using OpenFin’s Chromium-based technology, are critical. In a digital-first world, users expect apps and platforms to be easy to navigate.

- Transparency: Clearly explain fees, terms, and conditions in straightforward language. Fintechs are dealing with something sensitive – a user’s money. Trust is paramount.

- Security: Robust security protocols are non-negotiable. Users need to trust that their financial information is secure. Platforms need to prioritize encryption and multi-factor authentication.

- Personalization: As Morningstar showcases its services tailored to different segments of the finance industry, personalization is key. Fintech solutions need to address the specific needs and goals of their target market. Whether it’s a Gen-Z focused banking services app (Pluto Money is a great example), a platform for seasoned investors, or tools for businesses to manage expenses, each user segment has distinct expectations and pain points.

Navigating the Fintech Landscape: What to Consider?

Understanding the fintech landscape can seem complicated, but focusing on specific questions helps provide more clarity. For those new to it, this can feel overwhelming.

How Do Fintech Startups Generate Revenue?

Fintechs often make money through several key revenue models, and they can implement several to fit their goals. Here are some of the more common methods:

- Transaction Fees: A small percentage of each financial transaction processed on their platform (common for payment gateways, online brokers, etc.). For example, platforms like TruMid, a bond trading platform, might use this.

- Subscription Fees: A recurring fee for using their platform or accessing premium features. Financial professionals using research and data from Reorg would see a recurring cost like this.

- Interest Income: From loans facilitated through their platforms (common for alternative lending platforms like Prosper and LendingClub). This is one of the most common ways personal finance companies offer access to larger-scale loans at lower rates.

Launching a Fin tech Start up: Key Steps

So you’re thinking about starting your own fin tech start up company? Here’s how you could start:

- Identify a Problem: Begin with a problem worth solving. Look for gaps in the market or ways to simplify complex financial processes. A useful strategy involves checking forums like Reddit to find common complaints from users.

- Build a Solution: Develop a tech-driven solution addressing your chosen problem. Focus on user-friendliness, security, and scalability. For example, think of solutions to complaints users might have shared.

- Seek Funding: Navigate the fundraising landscape. Research different funding options, such as angel investors, venture capitalists, or crowdfunding. Sites like AngelList, Crunchbase, or industry events are good places to connect with potential investors. Don’t be shy—perfect your pitch. Having a clear and concise explanation of what your startup offers will resonate with investors.

- Acquire Licenses and Compliance: Financial regulations can be daunting for startups, especially for niche companies like Mason Finance, which specifically works with life insurance settlements and requires niche licensing. Make sure to comply with all the requirements. Hire legal experts specializing in financial regulations. Working with experienced attorneys helps avoid headaches down the line. Compliance adds credibility, builds trust, and is a critical aspect of investor and user confidence.

FAQs about Fin Tech Start Up

What is a Fin tech Start up?

A fin tech start up is a company that combines finance and technology to offer innovative financial products or services. They often leverage technology to offer more efficient, accessible, or cost-effective solutions than traditional financial institutions. Fintech startups can encompass many sectors, such as mobile payments, lending platforms, robo-advisors, personal finance management tools, blockchain-based solutions, and insurance technology.

Can You Start a Fintech Company?

Yes, anyone with a great idea and passion can start a fintech company. But, you will need to navigate several steps, like: a) Idea Validation: Make sure your solution addresses an actual market gap, b) Team Building: Form a team of experienced individuals with expertise in finance, technology, marketing, and regulations, c) Funding: Secure adequate funding to develop your platform and cover initial costs, d) Technology: Build a user-friendly and secure platform, and e) Regulatory Compliance: Acquire the licenses needed to operate within specific financial regulations. These steps can make launching and operating legally far more manageable.

How Does Fintech Make Money?

Fintech companies make money through a variety of revenue models: a) Transaction Fees: Charge users for every financial transaction made via their platform. For instance, payment gateways charge a percentage per transaction. b) Subscription Fees: Charge monthly/annual subscriptions for platform use or premium features. Robo-advisors use this by taking a percentage of assets managed. c) Interest Income: If connecting lenders and borrowers, they might keep a portion of the interest paid. Loan origination fees and late payment fees also help bring in revenue for fintech lenders.

What are the Largest Fintech Companies?

Some well-known Fintech companies include a) Stripe, a widely recognized name offering online payment processing for various online businesses (Acquired by PayPal) b) Chime, a popular mobile banking platform that has gained significant traction due to its convenient features and user-friendly bank account interface, and c) Robinhood, known for democratizing investing, allowing users to trade stocks and cryptocurrency without any commission fees, which attracted millions of users, although also faced regulatory challenges along the way. Although they started small, their dedication to solving real customer problems and leveraging tech innovatively cemented their success in the competitive landscape of the financial technology industry.

Conclusion

Fin tech start ups represent the future of finance. With fintech platform technology continuously evolving and customer demands growing more sophisticated, those able to adapt and cater to the changing needs of businesses and consumers will be well-positioned to navigate the future of financial services. It will continue to reshape how we save, spend, invest, and interact with the world of money.

Subscribe to my LEAN 360 newsletter to learn more about startup insights.